Notícias da Indústria

23 de dezembro de 2024

When President Joe Biden stepped onto Angolan soil for his recent state visit, it marked a significant milestone in the evolving trajectory of U.S.-Angola relations. Though Angola has long been recognized for its vast natural resources—particularly in oil, minerals, and agriculture—this visit signaled a renewed American interest beyond the traditional extractive sectors. President Biden’s engagement with Angola’s leadership and key stakeholders underlines a forward-thinking strategy that may influence the nation’s economic landscape for years to come.

1. Moving Beyond Oil and Gas

Angola is currently Africa’s second-largest oil producer, pumping approximately 1.18 million barrels per day in 2023. Historically, the oil sector has accounted for around 50% of the country’s GDP and over 90% of export revenues, creating economic vulnerabilities tied to global price fluctuations. During President Biden’s visit, U.S. officials hinted at encouraging diversification, suggesting potential U.S. investment in renewable energy projects worth an estimated $250–$400 million over the next five years. This shift would enable Angola to develop stronger industrial and agricultural bases, potentially increasing non-oil sector GDP contributions from the current 30% to nearly 40% by the end of the decade.

2. Infrastructure and Connectivity Investments

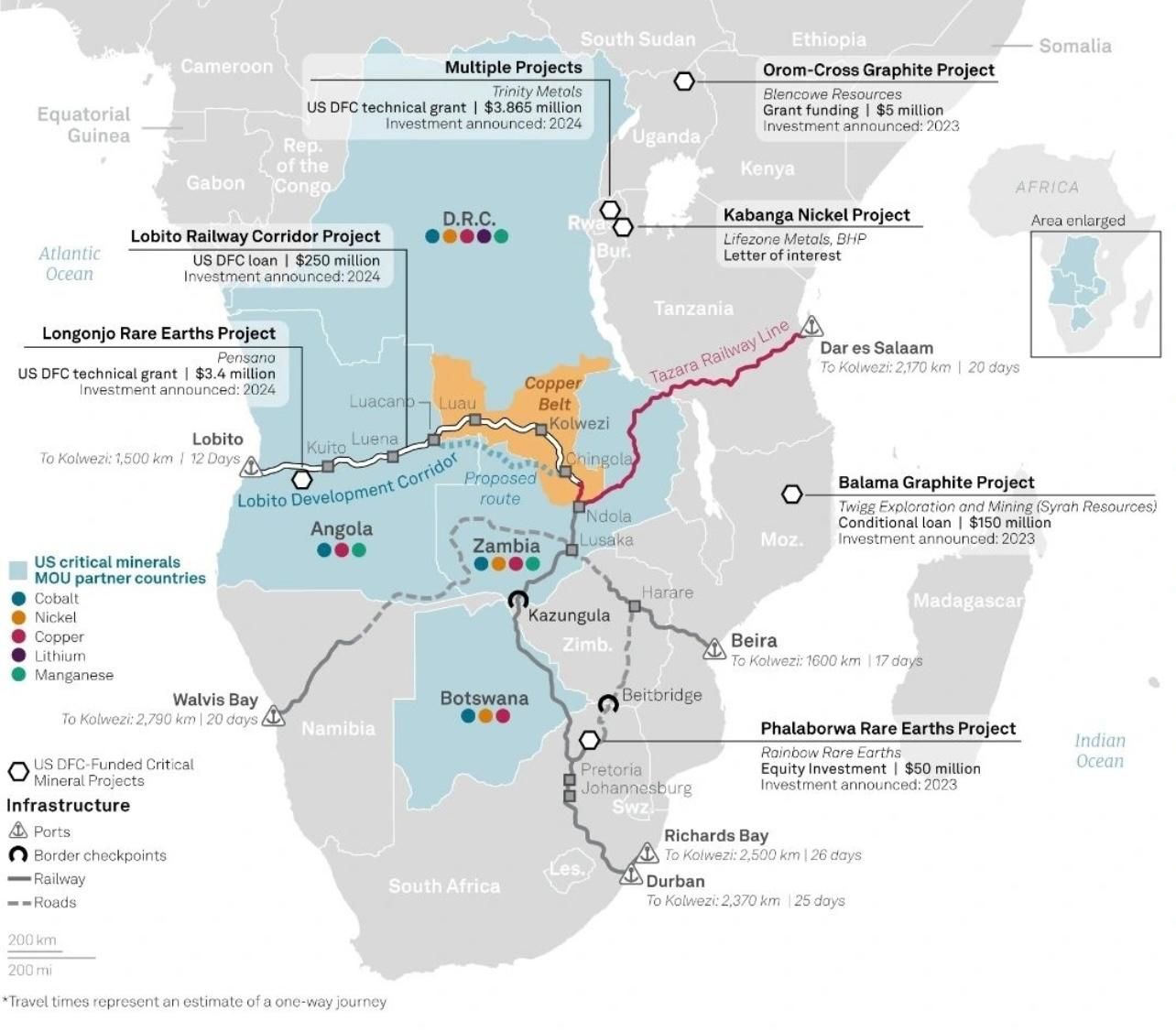

Angola’s infrastructure gap is significant: according to regional development data, only about 40% of the country’s roads are paved, and less than 30% of the population has reliable internet access. The Biden visit highlighted the possibility of U.S. credit facilities and private-sector partnerships funneling an estimated $1 billion into upgrading ports, railways, and broadband infrastructure by 2030. These improvements could reduce logistics costs by 10–15% and potentially boost Angola’s non-oil export volume by as much as 20% over the next 7–10 years, enhancing its appeal as a regional trade hub.

3. Catalyzing Innovation and Entrepreneurship

Angola’s median age is around 16 years, and more than 65% of its population is under 25, a demographic primed for entrepreneurial growth. U.S. support, including plans for new vocational training centers and digital skill accelerators, could help train an additional 50,000–80,000 Angolan youths over the next three years. Early estimates suggest that this skill infusion might lead to a 25–30% increase in the number of tech startups and small businesses able to secure seed funding by 2028, laying the foundation for an innovation-driven economy less reliant on natural resources.

4. Banking on Financial Reforms

Angola has made strides in strengthening its financial sector, with the central bank’s reforms in 2020–2022 contributing to a more stable exchange rate—the kwanza appreciated by nearly 20% against the U.S. dollar in that period. President Biden’s endorsement of ongoing financial transparency measures and corporate governance improvements could draw in an additional $200–$300 million in foreign direct investment (FDI) annually. Over time, this influx of capital could lower the cost of borrowing for local enterprises by 2–3 percentage points, enabling more sustainable growth and improving the competitiveness of Angolan firms globally.

5. Re-Branding Angola for Global Markets

Global perception matters. Despite having a GDP of around $74.5 billion (2022) and rich mineral reserves, Angola’s prior image as an oil-dependent economy with bureaucratic hurdles limited foreign engagement. With the high-profile Biden visit covered by international media outlets and the government’s ongoing anti-corruption campaign—which has already led to the recovery of an estimated $5 billion in misappropriated funds—Angola can significantly enhance its investment narrative. Analysts project that if policy reforms stay on track, Angola’s non-oil FDI could rise from roughly $1.5 billion in 2023 to over $2.5 billion by 2030, amplifying its role as a pivotal growth market in Africa.

Conclusion: A Moment of Transformation

President Biden’s state visit symbolizes a strategic pivot in U.S.-Angola economic relations, with implications resonating through energy diversification, infrastructure development, entrepreneurial support, financial reforms, and global branding. Backed by the potential flow of billions in investments and a youthful, eager workforce, Angola can seize this moment to transition into a more resilient and globally competitive economy. For American businesses and investors eyeing Africa’s next growth frontier, these statistics paint a picture of a nation on the cusp of profound transformation—and one well worth watching.

Follow us on social media, for more insights!