Notícias da Indústria

9 de setembro de 2024

The fintech industry has experienced a wild ride over the past few years, marked by sky-high valuations, sharp corrections, and a cautious rebound. As 2024 unfolds, the sector continues to evolve, riding the waves of recovery with some significant trends shaping its future.

From Peaks to Troughs: The State of the Market

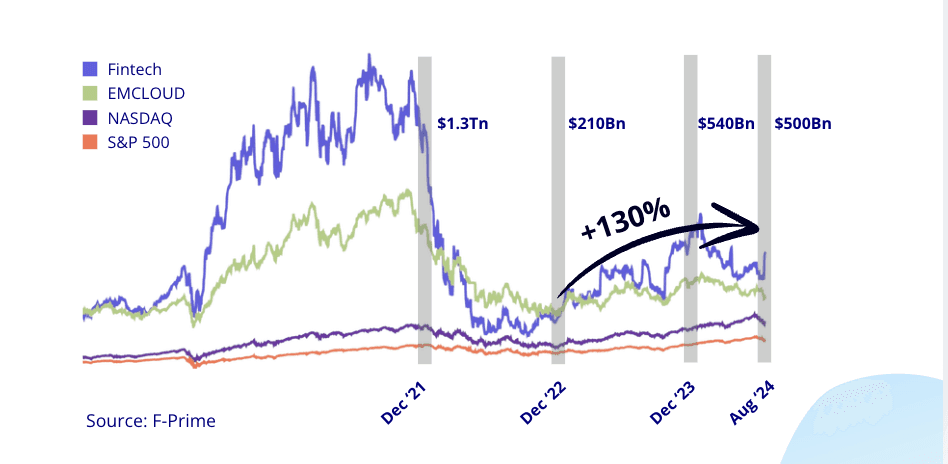

At its height in 2021, fintech was a booming sector, drawing massive investments and inflating valuations. However, by 2022, the reality check arrived, with many companies facing a downturn as capital dried up and growth expectations were tempered. Despite these challenges, 2023 marked the beginning of a new recovery. According to the F-Prime Fintech Index, the industry has seen a remarkable 130% growth since December 2022.

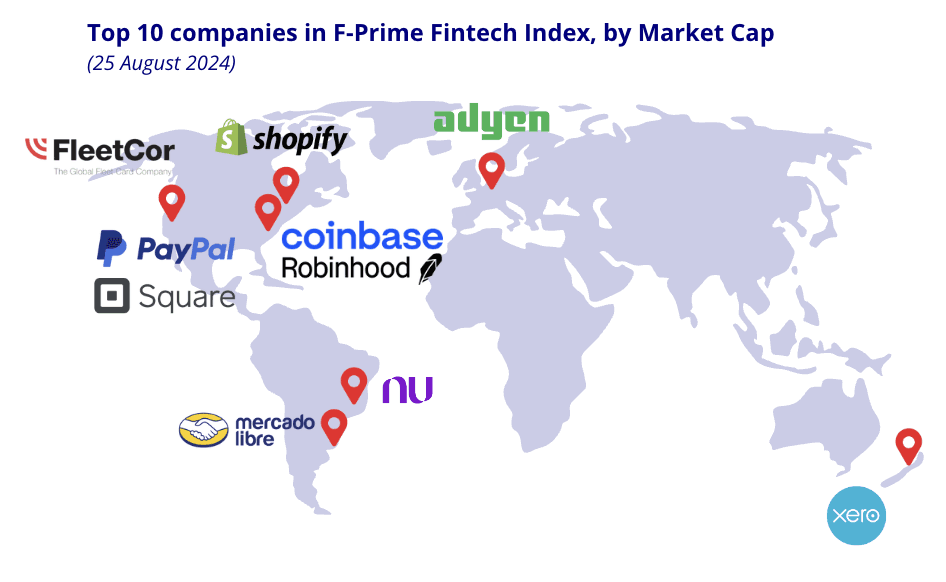

Top companies like MercadoLibre, Shopify, PayPal, and NuBank are leading this rebound, positioning fintech as a critical player in the broader financial ecosystem.

Public vs. Private Markets: A Tale of Two Realities

While public fintech companies are benefiting from this rebound, private fintech markets are still struggling. The data shows a 50% reduction in funding for private fintech companies in 2023 compared to the previous year. In fact, 4 out of 10 fintech companies that raised Series A funding in 2021 have not been able to secure further investment since then.

This divide highlights the current funding challenges in the fintech space, where private startups are finding it harder to attract capital while larger, established players thrive in public markets.

The Future of Fintech: Bright Horizons Ahead

Despite the recent rollercoaster ride, the long-term outlook for fintech remains promising. Experts predict that fintech's share of the global financial services market will grow from 2% to 25% by 2030, with emerging markets like Asia-Pacific and Africa playing pivotal roles in this growth. These regions are poised for significant fintech adoption, driving financial inclusion and transforming how financial services are delivered.

Business-to-business (B2B) and B2B2X models are expected to lead the next wave of fintech innovation, addressing the unmet needs of small and medium-sized businesses. As the sector matures, fintech companies are focusing on creating more tailored solutions to meet the evolving demands of their clients.

Conclusion: A Promising Path Forward

While challenges remain, especially in private markets, the fintech industry is clearly on a path of recovery and growth. The next few years will be crucial as companies refine their strategies, focus on underserved markets, and leverage technological innovations to expand their reach.

As the sector heads toward its projected $1.5 trillion revenue by 2030, fintech is set to become an indispensable part of the global financial landscape, with transformative growth driven by emerging markets and new business models.

If you're passionate about fintech's potential or navigating this rollercoaster, now is the time to stay informed and engaged.

Follow us on Linkedin

👍 Like | 💬 Comment | 🔗 Share | ➕ Subscribe

Connecting Africa, Empowering You!

Comments